Wyoming Credit: Reliable Financial Solutions for every single Stage of Life

Wyoming Credit: Reliable Financial Solutions for every single Stage of Life

Blog Article

Experience the Difference With Cooperative Credit Union

Subscription Benefits

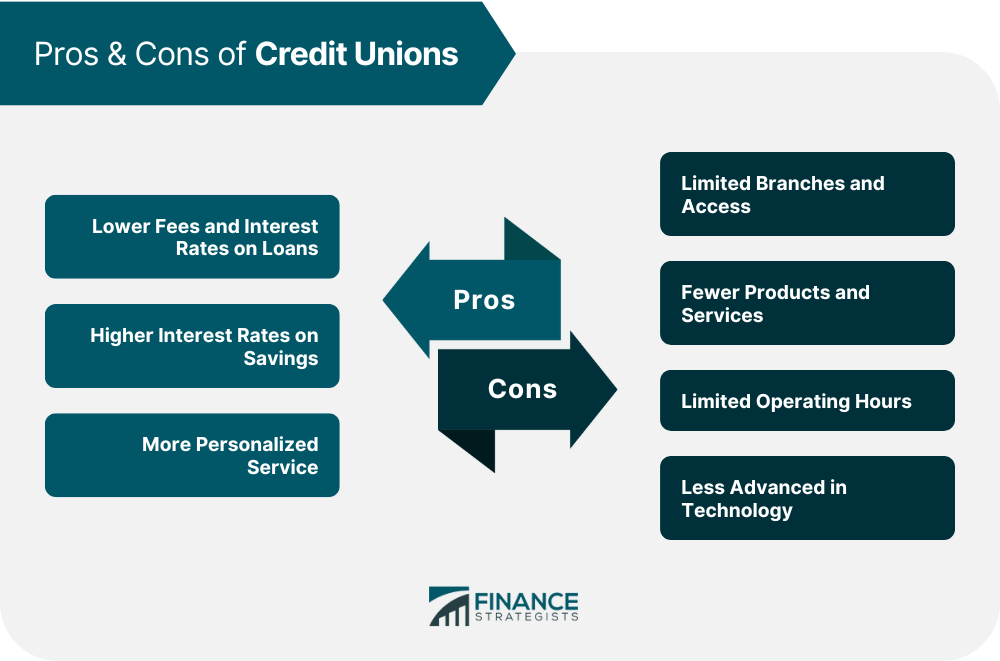

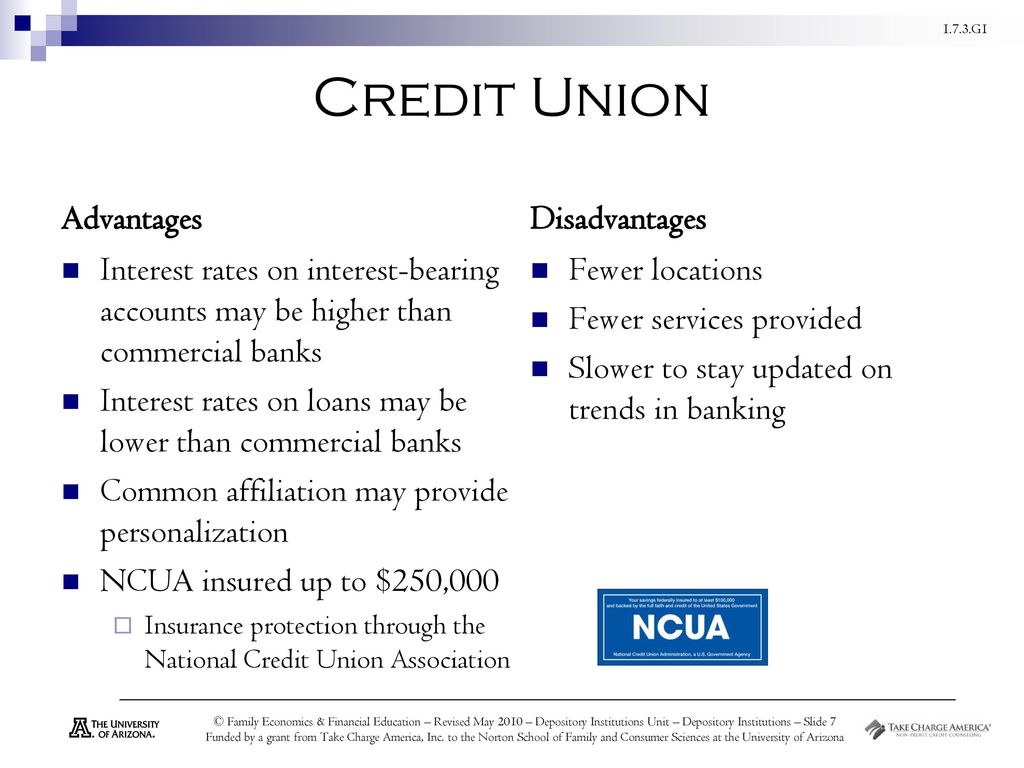

Lending institution use a variety of useful benefits to their participants, identifying themselves from standard banks. One crucial advantage is the emphasis on member possession and democratic control. Unlike banks, cooperative credit union are owned by their members, that additionally have ballot rights to choose the board of supervisors. This member-centric technique usually translates into better interest prices on interest-bearing accounts, lower loan rates, and minimized fees compared to for-profit banks.

Another significant benefit of lending institution is their focus on area involvement and support. Lots of credit rating unions actively join community advancement jobs, financial education programs, and charitable campaigns. By fostering a solid sense of area, cooperative credit union not only provide economic solutions but also contribute to the general health and success of the communities they serve.

Furthermore, lending institution focus on financial education and learning and empowerment (Wyoming Credit Unions). They provide resources and support to assist participants make educated decisions regarding their funds, enhance their credit history, and achieve their long-lasting monetary objectives. This commitment to education and learning collections cooperative credit union apart as relied on monetary partners committed to the monetary wellness of their members

Customized Client Service

Delivering tailored aid and individualized attention, lending institution succeed in providing tailored client service to their participants. Unlike traditional financial institutions, cooperative credit union prioritize constructing strong relationships with their members, concentrating on recognizing their unique needs and financial goals. When a member interacts with a lending institution, they can expect to be dealt with as a valued person instead of just an account number.

Lending institution often have neighborhood branches that enable in person interactions, boosting the personal touch in client service. Members can speak directly with educated team that are committed to assisting them browse monetary decisions, whether it's opening a new account, getting a financing, or seeking guidance on managing their financial resources. This tailored method sets cooperative credit union apart, as members really feel sustained and equipped in accomplishing their financial goals.

Additionally, credit report unions also use convenient digital banking solutions without endangering the individual connection. Members can access their accounts on the internet or via mobile apps while still receiving the same degree of individualized help and treatment.

Affordable Rate Of Interest

When looking for monetary items, members of lending institution benefit from affordable rate of interest that can improve their savings and obtaining possibilities. Lending institution, as not-for-profit financial organizations, frequently provide a lot more beneficial rate of interest compared to traditional financial institutions. These affordable prices can put on different economic items such as savings accounts, deposit slips (CDs), individual lendings, home mortgages, and charge card.

Among the key advantages of debt unions is their emphasis on offering participants instead of making best use of profits. This member-centric method enables lending institution to prioritize offering lower rate of interest on lendings and greater interest rates on interest-bearing accounts, offering participants with the opportunity to expand their cash more efficiently.

In addition, lending institution are understood for their determination to collaborate with members who might have less-than-perfect credit rating. Regardless of this, cooperative credit union still strive to preserve affordable rate of interest, ensuring that all click for more info participants have accessibility to budget friendly economic remedies. By capitalizing on these competitive rates of interest, credit score union members can maximize their funds and attain their cost savings and borrowing goals extra effectively.

Lower Prices and costs

One significant attribute of lending institution is their commitment to reducing costs and costs for their members. Unlike typical banks that usually focus on optimizing revenues, lending institution operate as not-for-profit companies, permitting them to offer much more desirable terms to their participants. This difference in framework equates to decrease costs and decreased prices across various services, profiting the participants straight.

Lending institution commonly charge lower account upkeep fees, over-limit fees, and atm machine fees compared to commercial banks. In addition, they often offer greater rates of interest on interest-bearing accounts and lower rate of interest on car loans, leading to total cost financial savings for their participants. By keeping costs and costs at a minimum, cooperative credit union aim to offer monetary services that are economical and available, cultivating an extra inclusive monetary environment for people and communities.

Essentially, choosing a cooperative credit i was reading this union over a standard financial institution can bring about significant expense financial savings in time, making it a compelling option for those looking for a more economical approach to financial solutions.

:max_bytes(150000):strip_icc()/dotdash-credit-unions-vs-banks-4590218-v2-70e5fa7049df4b8992ea4e0513e671ff.jpg)

Area Involvement

With a strong emphasis on fostering close-knit partnerships and sustaining regional efforts, cooperative credit union actively engage in community participation efforts to encourage and boost the locations they serve. Neighborhood involvement is a keystone of credit scores unions' values, mirroring their commitment to repaying and making a favorable influence. Cooperative credit union often get involved in different neighborhood tasks such as volunteering, funding local events, and offering monetary education programs.

By proactively joining neighborhood events and campaigns, lending institution show their dedication to the health and success of the communities they serve. This involvement exceeds just economic purchases; it showcases a real interest in developing solid, sustainable neighborhoods. Through collaborations with local companies and charities, credit score unions add to boosting the high quality of life for citizens and cultivating a sense of unity and support.

Moreover, these community participation efforts aid to develop a positive photo for lending institution, showcasing them as trusted and reputable partners purchased the success of their participants and the area at large. On the whole, community participation is a vital aspect of lending institution' operations, enhancing their commitment to social duty and area growth.

Conclusion

In final thought, cooperative credit union supply numerous advantages such as democratic control, better rate of interest prices, reduced car loan rates, and minimized costs contrasted to for-profit banks. With individualized client service, affordable rate of interest, reduced fees, and a commitment to community participation, lending institution give a special worth suggestion for their members. Stressing monetary empowerment and community development, cooperative credit union attract attention as a beneficial choice to standard for-profit financial institutions.

Report this page